To put it simply, CBDC can be called the digital form of a country’s fiat currency. Instead of printing notes and minting coins, the central bank issues digital currency which is denominated in the national unit of account. Although the particulars can vary because of many CBDCs being in the early stages of conception or experimentation, there are some underlying features of this new concept that seems to be the same in every case.ĬBDC is digital money issued by the central bank which means it is a central bank liability.

But presently it is being mulled over and experimented with in different ways by governments across the world. The theoretical concept of Central Bank digital currency (CBDC) came up years ago. This paper attempts to study all these sources and expound on the implicit as well as explicit implications. Although little information has been revealed about the DCEP system, multiple documents and statements about the DCEP on different occasions shed light on some of the details of the functionality of DCEP. This paper looks into the features of China’s DCEP, its domestic prospects, and its international ambitions and scope. Only then global standards around DCEP would be set in an inclusive manner. Research and development of CBDC should be expedited in other countries as well in order to counter the first-mover advantage that China’s DCEP possesses. It can potentially influence the global financial system. Because its implications on the monetary and financial system can be far-reaching, not only for the region but also for the whole world. The fact that none of the major economies have attained what China has, in terms of development and testing of its CBDC is reason enough to be alarmed. The broader aim can be inferred as a push to internationalize RMB and challenge the dominance of USD in international trade. It is not only testing the domestic prospects but also looking into using it to facilitate cross-border payments. As of now, China has been able to position itself as the forerunner in this race with rounds of successful trials of its own version of CBDC, the technical term of which is known as DCEP(Digital currency/Electronic payment) and the general term known as Digital Yuan/eCNY/Digital RMB. A combination of factors like shifts in payment modes and the increasing popularity of cryptocurrencies and stablecoins have led Central banks to realize that they will have to be in it to win it or else they will lag behind in the race of evolution of money. With around 86% of the world's central banks engaged in CBDC related work, it is evident that CBDCs are being viewed as an important development in the Fintech domain to counter cryptocurrencies and in order to maintain monetary sovereignty. Suppose an e-CNY has been minted and released In that case, it can be exchanged, stored, and spent by various businesses (exchanges, wallets, financial services) and individual traders trying to escape the cryptocurrency markets’ often severe uncertainty, and the security backed by Chinese Bank Reserves.The concept of Central Bank Digital Currency (CBDC) seems to have gained traction over the past few years and is well past the stage of conception. e-CNY would eventually lead to a cashless world.Įach e-CNY is exchangeable for a corresponding exchange rate to the Chinese yuan backed by the Chinese government. Cashless transactions accounted for four out of five payment transactions in 2020, totaling 320 trillion yuan (US$49 trillion). In recent years, China has moved closer to being a cashless country. Both commercial and central banks including Blockchain holders are keeping the detailed records of the flow of digital currency, so the beauty of this token is, it can’t be stolen or spend illegally, in any of these cases the transfer will be traced and the first holder will get the same amount of e-cny with official police complaint anywhere in the world.

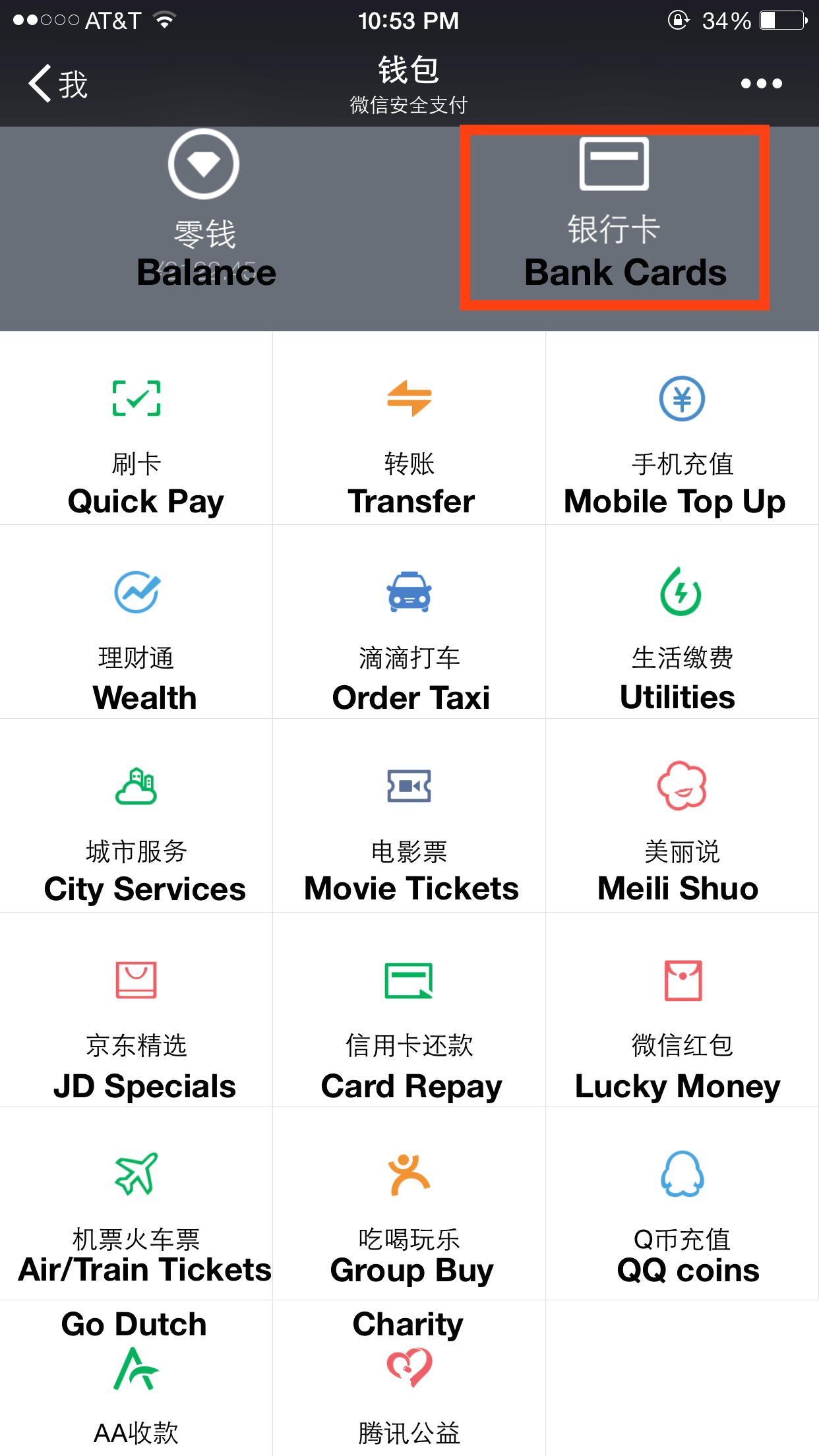

Commercial banks will potentially be involved in distributing digital currencies and will be required to deposit the same amount of reserves with the e-CNY as they distribute. The Electronic Payment providers are going to implement the integration of this token for digital payments the top of list Chinese companies in the earlier trials are Tencent’s WeChat Pay, Alibaba’s, Alipay.ĭigital money intends to replace cash in circulation rather than long-term bank deposits. Finally, China has introduced its first Central Bank Digital Currency (e-CNY), or Digital Yuan, which was developed using its new payment system and it’s built on top of Binance Smart Chain blockchain.

0 kommentar(er)

0 kommentar(er)